Insights

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Platform

ALTAIR PANOPTICON™ & IMAGINE – A Compelling Combination

Steven Harrison, President of TS Imagine, and Bruce Zulu, Director of Technical Support Services for the Business Intelligence division at Panopticon’s parent company, Altair, explain the collaboration and how it benefits clients.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

How a Stressful Election Could Stress Your Portfolios

Most market observers agree that the many uncertainties swirling around the US Presidential election are likely to generate volatility in the US equity market that could last well beyond November 3rd.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

When the Market Flips its Lid, What Does it Mean for LDI?

An area of investment management that is particularly exposed to changes in interest rates (nominal and real) is the world of Liability-driven Investing (LDI). This eBook provides an overview of the concept, and then dives into the key questions regarding risk management for liability-driven investing and provides technology tips.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

POMS or OEMS

Market insight: A view into a current technology trend in the market, with surprisingly only one men...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

Hedge Funds losing millions annually as manual processes and old technology takes its toll on trading

Wednesday, September 16, 2020 – Hedge Funds are absorbing a punishing $8 million annual hit to the...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Data / Data Quality

Thinking about Building a Volatility Surface? Think Again

At first glance, constructing a volatility surface looks like a straightforward exercise – a closer look reveals there is a great deal more to consider.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Partners

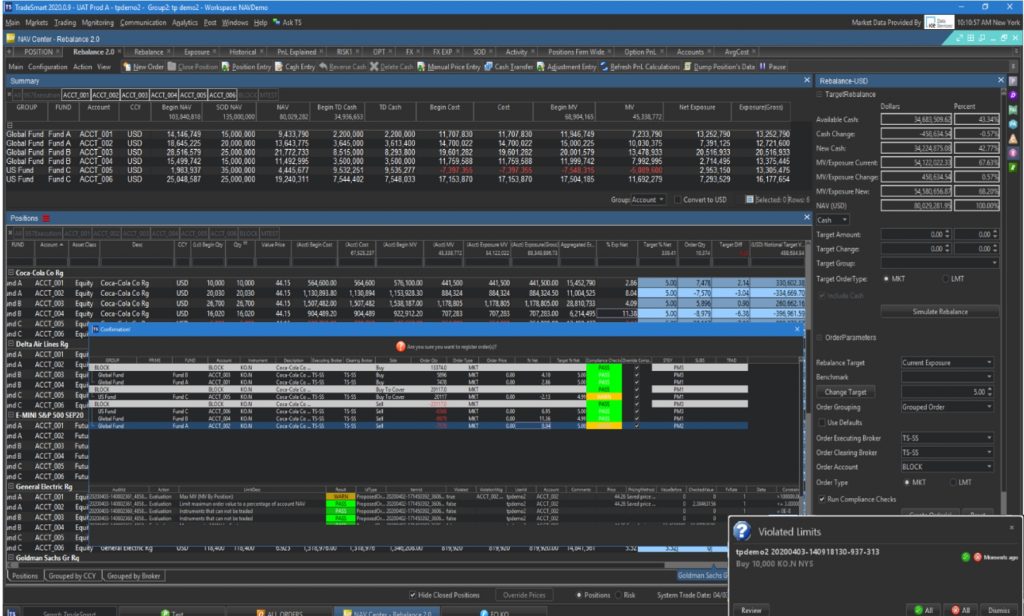

Buy-side boost as TradingScreen and TS Imagine enhance partnership

TradingScreen Inc (TS), the all asset class execution and order management system (EOMS), and TS Imagine, leading provider of portfolio and risk management solutions, have enhanced their long-standing partnership to deliver a full front-to-back office trading solution to the buy-side.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

Buy-side boost as TradingScreen and TS Imagine enhance partnership

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Platform

TS Imagine embeds Panopticon: Delivering Business Intelligence and optimized data visualizations

TS Imagine is the leading provider of real-time portfolio, risk management, and regulatory solutions for global financial services firms. Its clients include many of the largest banks, asset managers, hedge funds, and institutional trading firms in the world.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

Q&A with asset manager Flossbach von Storch: COVID-19 as a catalyst for transformation

With COVID-19 having a profound impact on the global markets, investment managers around the world a...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

Why the consolidated approach is addressing OMS and EMS deficiencies

As we move into the second half of 2020, hedge funds and asset management firms continue to face pre...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

The Lognormal Bridge

This note discusses the use of a “lognormal bridge” to estimate interest rate statistics and to calculate HVAR.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

TradingScreen (TS) Announces Changes to Board of Directors

New York, NY— 7/14/2020 -- TradingScreen Inc. (TS), the global, multi-asset class order and execut...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

Calculating Risk Under Market Uncertainty:

There is No Right Answer

When newcomers to the field of quantitative finance are assigned the task of writing up an analysis, they will often show numbers using five, six or even more digits to the right of the decimal point. This may be driven by the part of the brain that craves precision and exactness. Given the unstable nature of financial data, does that mean it is a fool’s errand to try to estimate risk?

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

SGX To Fully Acquire BidFX, Advancing Its Global Ambitions To Offer End-To-End FX Platform And Solutions

TS is pleased to announce the news regarding the acquisition of TradingScreen's FX division, BidFX, ...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

Risk Monitoring Through Turbulent Markets

Markets change frequently and often erratically, presenting risk managers, asset managers, and investors with enormous uncertainty. Given the market volatility in recent months, it is especially important to monitor real-time risks and to test a portfolio’s resilience under future possible market fluctuations.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

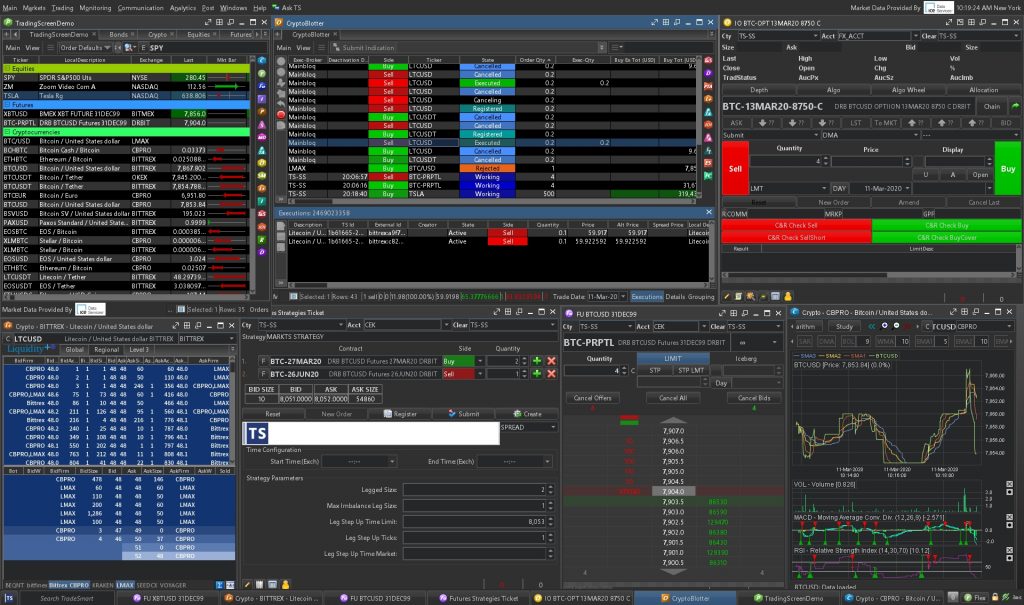

TradingScreen enters the cryptocurrency space with MARKTS

TradingScreen enters the cryptocurrency space with MARKTS Despite the flagrant headlines, one thing...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Quant

TS Imagine’s Response to Negative Oil Prices

It was a historic moment to be remembered when crude oil plunged into negative price territory on Monday 20th April 2020. TS Imagine’s Data, Technical, Development and Professional Services teams stood ready to assist users in ensuring they continued to correctly calculate risk metrics across commodity trading books. While negative prices are not a new thing in financial markets, it was the first time for crude oil to exhibit such behaviour. Standard pricing models (Black Scholes) for commodity future options are not designed to handle negative underlying prices. As such, TS Imagine applied an ‘early roll’ of the front month contract of May crude to the June expiry as the negative settle price was confirmed.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

The Finance Hive: Annual East Coast Meeting

The objective of our annual East Coast Finance Hive Meeting is to bring the East Coast senior FX buy...

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Platform

TS Imagine Partners with Tora to Create Best-in-Class Global Trading Platform

TORA, provider of the industry’s most advanced cloud-based and leading order and execution management system (OEMS), has today announced a partnership with premier risk & compliance platform provider, TS Imagine to create the finest front-to-back end trading solution for hedge funds & asset managers.