News

An Industrial Strength Recon System

In the wake of the 2008 Financial Crisis, another layer of complexity in regulatory requirements has been added to the operational structure of investment management firms. Market-shifting events like the Madoff Ponzi scheme and Lehman Brothers bankruptcy created a need for checks and balances to ensure reconciliations are done by an outside party to further protect investors. In the light of these developments, it has become increasingly important for managers to have access to trade and position level information at all times. Therefore, managers have been investing more time and effort into their operational processes and infrastructure around data and analytics as the demand for reporting and regulatory scrutiny has dramatically increased. In our view, a sound infrastructure armed with on-demand tools provides the best defense against regulatory breaches and operational failure.

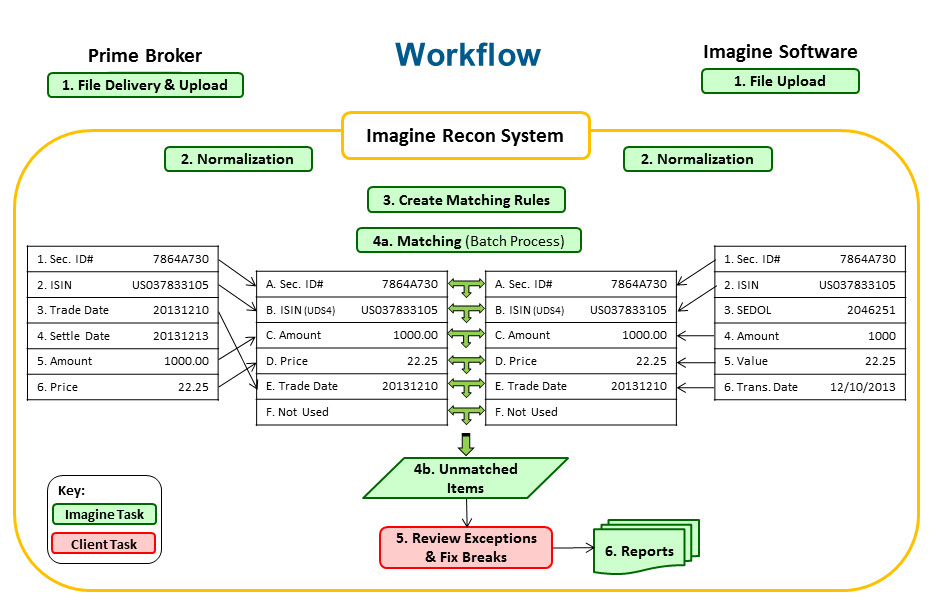

The new TS Imagine Reconciliation System is a web-based solution that is made to fit perfectly into any operational infrastructure and is capable of addressing the entire reconciliation life cycle. With automated matching and exception processing, our reconciliation product lowers operational risk while at the same time reducing operational costs. As we have observed with many managers in the industry, manual reconciliation can take several hours a day while creating a higher risk of potential of errors. Our reconciliation system infrastructure sits on a complex backbone directly hooked up to your TS Imagine account, where your positions reside. Our system is on-demand, reliable, and can process thousands of trades within a matter of seconds while offering a simple, intuitive end-user experience.

TS Imagine Does the Heavy Lifting

TS Imagine consultants offer a no-impact implementation with a product that is scalable for any size business. By managing approximately 80% of the workflow, this product will reduce your team’s efforts significantly.

Our reconciliation product provides canned dashboards that are tailored to delivering immediate views and easy drill-downs of your important data providing you with operationally critical analytics.

With a super low-impact implementation, an on-demand, web-based product with a robust reconciliation engine might be what you need to make your operational infrastructure stronger. TS Imagine can make this easier to achieve than you might think.

Related News

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

White Paper:

Predicting the Past

Historical VaR (HVaR) has become a standard measurement of risk. Many firms now require a full twelve years of prices (plus data from further back such as the Great Recession of 2008–2009). However, this requirement introduces a conundrum: what do we do when a company has not been around for a full twelve years?

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

Chartis RiskTech BuySide 50 report: TS Imagine wins Technology and Techniques Category

TS Imagine is proud to announce that we have been ranked no 1 in the Technology and Techniques category by Chartis Research in the Chartis RiskTech Buyside 50 report.

Warning: Undefined variable $postId in /home/kraus/samplesite2/wp-content/themes/imaginesoftware/page-templates/part-newsentry.php on line 70

/ Risk Management

Enriching the HVaR Calculation:

Predicting the Past:

HVaR, By Dr Lance Smith, Chief Strategy Officer, TS Imagine Historical VaR (HVaR) has become a standard measurement of risk, in which a current portfolio is subjected to the market conditions of a prior day and the resulting P&L is recorded. Read entire article here.